Welcome to the fascinating realm of captive insurance, where businesses can harness the power of self-insurance to mitigate risk and potentially save costs. This innovative concept has gained significant traction in recent years, with a particular focus on Section 831(b) of the tax code, also known as the 831(b) election or microcaptive insurance. By understanding the ins and outs of captive insurance, you can unlock a world of benefits that may revolutionize the way you protect your business.

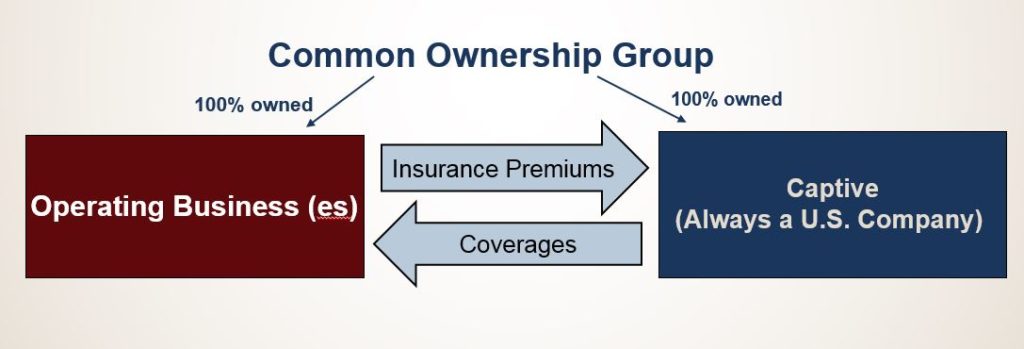

So, what exactly is captive insurance? Simply put, it is a form of self-insurance in which a company creates its own insurance company, known as a captive. This captive then assumes the risk and provides coverage for the parent company and any affiliated entities. By establishing a captive, businesses can tailor insurance programs to their specific needs, rather than relying solely on traditional commercial insurance policies.

One of the key drivers behind the rise of captive insurance is the potential tax advantages offered by the IRS 831(b) tax code. This code provides certain tax benefits for small captive insurance companies that meet specific criteria, such as limiting annual written premiums and having a diversified risk pool. This has led to the emergence of microcaptives, which are captives that qualify under the 831(b) tax code.

Exploring the world of captive insurance not only offers businesses the opportunity to gain control over their insurance programs but also allows them to potentially enjoy tax advantages. As we delve deeper into this captivating subject, we will uncover the various benefits that can be unlocked through the strategic utilization of captive insurance. So, join us on this insightful journey as we navigate the intriguing landscape of captive insurance and discover the possibilities that lie within.

Understanding Captive Insurance

Captive insurance, also known as microcaptive insurance, is a unique form of self-insurance that allows businesses to manage their own risks. Unlike traditional insurance, where companies pay premiums to external insurers, captive insurance involves the creation of an in-house insurance company. This captive insurer then provides coverage for the risks of its parent company and affiliated entities.

The popularity of captive insurance has increased in recent years, partly due to the introduction of the IRS 831(b) tax code. This tax code allows smaller captive insurance companies with annual premiums under $2.3 million to benefit from certain tax advantages. Under this provision, these companies can elect to be taxed only on their investment income, rather than their underwriting profits.

Microcaptive

Captive insurance provides several benefits to businesses. Firstly, it allows companies to have more control and flexibility over their insurance arrangements. By creating their own captive insurance company, businesses can tailor insurance coverage to their specific needs and risks. This level of customization can often lead to more comprehensive coverage and cost savings.

Additionally, captive insurance can be a strategic financial tool. When structured properly, captives can help businesses manage and minimize risk, and potentially generate additional income through investment activities. This makes captive insurance an attractive option for companies looking to take a proactive approach to risk management while also unlocking potential financial benefits.

Overall, captive insurance offers a unique alternative to traditional insurance arrangements, providing businesses with greater control, flexibility, and potential financial advantages. The introduction of the IRS 831(b) tax code has further contributed to the growth of captive insurance, making it an appealing option for businesses of various sizes.

Exploring the IRS 831(b) Tax Code

The IRS 831(b) tax code is a significant aspect of the captive insurance industry. It provides businesses with the opportunity to form small insurance companies known as microcaptives. These microcaptives offer various benefits to their owners, including potential tax advantages.

One key advantage of the IRS 831(b) tax code is the ability for microcaptives to receive favorable tax treatment. Under this code, microcaptives can elect to be taxed only on their investment income, rather than their premium income. This means that the premiums received by a microcaptive are not subject to federal income tax, allowing businesses to retain more of their insurance premiums for potential future losses.

Another benefit of the IRS 831(b) tax code is the potential for businesses to accumulate wealth through their microcaptives. Since microcaptives have the option to retain underwriting profits instead of paying them out as ordinary income, businesses have the opportunity to build reserves over time. These accumulated reserves can then be invested, potentially growing the wealth of the business.

Furthermore, the IRS 831(b) tax code provides flexibility for businesses to customize their insurance coverage. Captive insurance allows companies to tailor their policies specifically to their unique risks and needs. This customization offers businesses the ability to obtain coverage that may not be readily available or affordable in the traditional insurance market.

In conclusion, the IRS 831(b) tax code plays a crucial role in the captive insurance industry. Microcaptives formed under this code can benefit from favorable tax treatment, wealth accumulation potential, and the flexibility to customize insurance coverage. Understanding and leveraging the opportunities provided by the IRS 831(b) tax code can unlock the benefits of captive insurance for businesses.

Benefits of Microcaptives

Microcaptives, also known as 831(b) captives, offer a range of benefits for businesses looking to enhance their risk management strategies. With the IRS 831(b) tax code providing favorable tax advantages, these captive insurance arrangements have gained popularity. Let’s explore the benefits of microcaptives in more detail.

Enhanced Risk Management: One key advantage of microcaptives is the ability to tailor insurance coverage specifically to a business’s unique risks. Unlike traditional insurance policies, microcaptives allow organizations to have greater control over their risk management strategies. By integrating captive insurance into their risk management framework, businesses can better protect themselves against unforeseen challenges and minimize their exposure to external risks.

Tax Advantages: Microcaptives, as defined under the IRS 831(b) tax code, enjoy substantial tax benefits. By electing to be taxed as a small insurance company, microcaptives are subject to a significantly reduced tax rate. This presents businesses with an opportunity to enhance their overall tax planning and contribute to their bottom line. The potential tax savings associated with microcaptives make them an attractive option for businesses seeking to optimize their financial performance.

Wealth Accumulation: Another significant benefit of microcaptives is their ability to facilitate wealth accumulation. In addition to providing insurance coverage, microcaptives can also act as an investment vehicle. As premiums are collected, the captive insurance company can invest these funds. Over time, this can lead to the accumulation of wealth and the potential for increased returns on investment. By combining insurance coverage with wealth accumulation potential, microcaptives offer businesses a dual benefit.

In conclusion, microcaptives provide businesses with a range of benefits, including enhanced risk management capabilities, tax advantages, and wealth accumulation potential. These advantages make microcaptives an appealing option for businesses seeking to bolster their risk management strategies and optimize their financial performance.